Credit Unions in Wyoming: Comprehensive Banking Solutions and Member Benefits

Wiki Article

Elevate Your Banking Experience With Credit Scores Unions

Exploring the realm of banking experiences can often lead to discovering covert gems that provide a revitalizing separation from conventional financial establishments. Credit score unions, with their emphasis on member-centric solutions and neighborhood involvement, present an engaging option to standard banking. By focusing on individual requirements and cultivating a feeling of belonging within their membership base, credit history unions have taken a specific niche that resonates with those seeking an extra customized approach to managing their financial resources. But what sets them apart in terms of boosting the financial experience? Let's delve deeper into the one-of-a-kind advantages that lending institution bring to the table.Advantages of Cooperative Credit Union

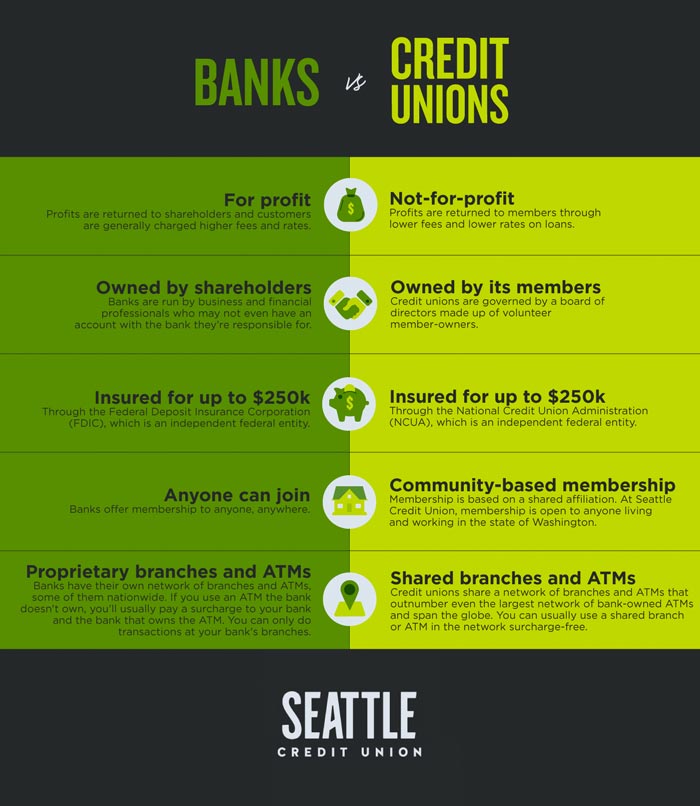

Using a series of economic solutions tailored to the demands of their participants, debt unions provide countless advantages that set them aside from traditional banks. One crucial advantage of cooperative credit union is their concentrate on neighborhood involvement and member complete satisfaction. Unlike financial institutions, credit history unions are not-for-profit organizations had by their participants, which commonly results in decrease costs and better interest prices on savings accounts, lendings, and bank card. In addition, lending institution are known for their personalized consumer solution, with employee putting in the time to understand the special economic objectives and challenges of each participant.

An additional benefit of credit history unions is their democratic framework, where each participant has an equivalent enact electing the board of supervisors. This makes certain that choices are made with the ideal rate of interests of the participants in mind, as opposed to focusing exclusively on taking full advantage of earnings. Additionally, credit history unions usually offer monetary education and learning and therapy to aid members improve their monetary literacy and make educated decisions regarding their cash. Overall, the member-focused strategy of lending institution sets them apart as establishments that focus on the well-being of their neighborhood.

Membership Requirements

Credit report unions typically have specific standards that individuals should meet in order to enter and accessibility their monetary solutions. Subscription requirements for lending institution frequently involve qualification based on aspects such as an individual's place, employer, business affiliations, or various other certifying connections. For instance, some lending institution might offer people who function or live in a particular geographical location, while others might be associated with certain companies, unions, or associations. In addition, relative of current cooperative credit union members are frequently eligible to sign up with also.To come to be a participant of a debt union, individuals are typically needed to open up an account and keep a minimal deposit as specified by the institution. Sometimes, there might be single subscription charges or recurring membership dues. When the subscription standards are met, individuals can appreciate the advantages of belonging to a lending institution, consisting of access to personalized monetary solutions, competitive rates of interest, and a focus on participant contentment.

Personalized Financial Providers

Individualized monetary services tailored to individual needs and preferences are a hallmark of cooperative credit union' dedication to member fulfillment. Unlike standard financial institutions that typically provide one-size-fits-all options, cooperative credit union take an extra personalized strategy to managing their members' funds. By understanding the distinct goals and circumstances of each member, cooperative credit union can Federal Credit Union offer customized referrals on savings, investments, lendings, and other economic products.Lending institution focus on developing solid partnerships with their participants, which allows them to offer customized services that go past just the numbers. Whether somebody is saving for a certain objective, preparing for retired life, or looking to boost their credit report, cooperative credit union can create tailored monetary plans to aid members attain their goals.

In addition, lending institution commonly provide reduced costs and competitive passion rates on savings and financings accounts, additionally boosting the individualized economic solutions they supply. Credit Unions Cheyenne. By concentrating on specific demands and delivering customized remedies, credit report unions establish themselves apart as relied on financial partners committed to assisting participants flourish financially

Neighborhood Involvement and Support

Neighborhood engagement is a foundation of cooperative credit union' objective, reflecting their commitment to supporting local campaigns and cultivating purposeful connections. Lending institution actively take part in neighborhood events, sponsor neighborhood charities, and arrange monetary literacy programs to educate members and non-members alike. By buying the areas they offer, cooperative credit union not only strengthen their partnerships however likewise add to the total health of culture.Sustaining little organizations is one more means cooperative credit union demonstrate their dedication to regional communities. Through providing little organization car loans and monetary advice, credit score unions help business owners prosper and stimulate financial growth in the area. This support goes past simply economic support; cooperative credit union frequently give mentorship and networking chances to aid local business are successful.

Moreover, credit report unions frequently engage in volunteer job, motivating their workers and participants to return through different social work activities. Whether it's taking part in local clean-up events or organizing food drives, cooperative credit union play an active role in boosting the quality of life for those in need. By prioritizing area participation and assistance, lending institution really symbolize the spirit of participation and mutual support.

Online Financial and Mobile Applications

Mobile apps used by credit score unions even more enhance the banking experience by supplying extra flexibility and access. Generally, credit score unions' online financial and mobile apps empower participants to manage their financial resources effectively and securely in today's busy digital globe.

Conclusion

In conclusion, credit rating unions use a distinct banking experience that prioritizes community participation, tailored service, and member complete satisfaction. With reduced charges, affordable interest rates, and tailored economic services, debt unions cater to private needs and promote monetary wellness.Unlike financial institutions, credit history unions are not-for-profit companies had by their participants, which frequently leads to reduce charges and much better passion prices on savings accounts, fundings, and credit scores cards. In addition, credit scores unions are understood for their personalized consumer service, with personnel members taking the time to understand the one-of-a-kind financial objectives and difficulties of each member.

Report this wiki page